Theta is an essential concept in options trading, as it can help determine how much an option’s price will change over time. Theta measures how quickly an option’s price will erode due to the passage of time and any other extraneous factors that may affect its value. Therefore, understanding how to use theta in your trading can be crucial to your success as an options trader.

How to use theta in your options trading

Understand what it measures

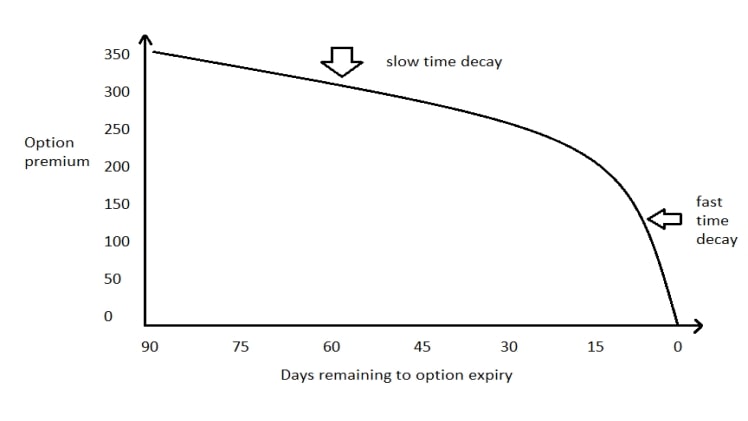

The first step in using theta in options trading is understanding its measures. Theta specifically refers to the rate of change in an option’s price due to time decay or how quickly its price will decrease over time as expiration approaches. It can be a useful measure when deciding when to close out your trades and take your profits, as well as when determining whether you want to buy or sell additional options contracts based on an expected change in volatility.

Determine how much time is left until expiration

To fully understand the impact of theta on your options trading, you must first determine how much time remains until your option’s expiration. You can do this by looking at various factors, such as the number of days that remain in the trading cycle or using a tool like an options calculator to figure out exactly how many days are left until expiration. Once you know this information, you can then use it to calculate the amount that your option’s price will likely decrease over time.

Factor in any expected changes in volatility

Along with considering the amount of time remaining before expiration, it is also essential to consider any expected volatility changes when deciding whether and when to close out your positions. As volatility is one of the factors that can affect an option’s price, it is essential to carefully consider any expected changes in the level of market volatility when making your trading decisions.

Consider other factors that could affect an option’s value

In addition to considering time and volatility, several other factors can impact the price of an option and its movement over time. Some examples include earnings announcements, dividend events, and news or rumours about the underlying stock. By being aware of these events and their potential impacts on your options trading, you can make more informed decisions about when to hold or let go of your trades based on theta.

Develop a trading strategy based on theta

Once you thoroughly understand how theta works and how you can use it in options trading, you can begin to develop your strategies for using this information to your advantage. For example, you might decide to close out or sell short expiring options as they approach their expiration date while buying longer-term contracts at lower prices during times of high volatility. By taking these actions and others informed by an understanding of theta, you can use this important concept to improve your trade performance and maximise your profits over time.

Practice using theta to analyse options trading scenarios

One effective way to build your skills and knowledge in using theta in options trading is to practice analysing different types of scenarios. You can do this by creating sample trades or by reviewing historical data from past market movements. By doing this regularly, you can gradually improve your ability to assess potential impacts on option prices based on time, volatility, and other essential factors that may affect them. With regular practice and a solid understanding of using theta in your trading decisions, you can become a more successful options trader.

Consult with a professional options trader for help

If you are new to options trading or want to improve your skills and knowledge, consulting with a professional options trader can be helpful. These traders have extensive market experience and understand how various factors, such as theta, affect option prices. By seeking out advice and guidance from these traders, you can learn valuable tips and strategies that can help you become a more successful options trader over time.

Click here to get more info.